The Southern California real estate market remains competitive in 2025, but rising interest rates are making homebuying more challenging. With mortgage rates averaging between 6.5% and 7.2%, buyers must take a strategic approach to secure the best deal.

However, higher rates don’t mean you have to delay your home purchase. In fact, there are still incredible investment opportunities—including ocean-view lands in Pacific Palisades for under $1 million—if you know where to look.

In this guide, we’ll explore expert strategies to navigate high-interest rates and highlight some of the best places to buy a home in Southern California in 2025.

1. Understanding Interest Rates in 2025

Mortgage rates have risen due to inflation, economic shifts, and Federal Reserve policies. While this increases borrowing costs, savvy buyers can still secure good deals by:

✔ Improving their credit score for better loan terms

✔ Exploring alternative mortgage options (like adjustable-rate loans)

✔ Negotiating with sellers for rate buydowns and closing cost assistance

Even with higher rates, waiting too long may result in higher home prices, making it more expensive to buy later.

2. Steps to Buy a Home in a High-Interest Rate Market

Step 1: Improve Your Credit Score

Lenders offer the best rates to buyers with credit scores of 740+.

✅ Pay down credit card balances

✅ Avoid new loans before buying a home

✅ Make all payments on time

A higher credit score can lower your mortgage rate and save you thousands over the loan’s lifespan.

Step 2: Save for a Larger Down Payment

With high-interest rates, a larger down payment reduces your loan balance and monthly payments.

- Aim for 20% down to avoid private mortgage insurance (PMI).

- If 20% isn’t possible, putting down at least 10-15% can still lower borrowing costs.

Step 3: Get Pre-Approved Early

A mortgage pre-approval locks in your rate for a limited time, giving you an advantage when house hunting.

✔ Compare lenders for the best rates

✔ Ask about rate-lock options to protect against increases

✔ Work with a mortgage broker to explore financing options

Step 4: Consider Adjustable-Rate Mortgages (ARMs)

Fixed-rate loans are common, but an adjustable-rate mortgage (ARM) might be a better option in a high-rate market.

- 5/1 ARM: Fixed for 5 years, then adjusts annually

- 7/1 ARM: Fixed for 7 years, then adjusts annually

If you plan to refinance or sell before the rate adjusts, an ARM could save you money.

Step 5: Negotiate for Seller Concessions

With demand slowing slightly due to rising rates, sellers may be more willing to offer:

- Rate Buydowns: The seller covers part of the interest rate cost for the first few years.

- Closing Cost Assistance: Sellers pay a portion of your closing fees.

- Home Upgrades: Instead of reducing the price, sellers may agree to make improvements.

Step 6: Explore Off-Market & New Construction Homes

- Off-market listings (or pocket listings) have less competition, leading to better deals.

- New construction homes often come with builder incentives, like rate buydowns or closing cost credits.

3. Best Places to Buy a Home in Southern California in 2025

Despite rising interest rates, some areas in SoCal still offer strong investment potential.

🏡 Corona del Mar – A luxury coastal community in Newport Beach with stunning homes and great long-term value.

🌆 Irvine – A thriving city with top-rated schools, strong job opportunities, and newer construction homes.

🏙️ Los Angeles – Offers diverse neighborhoods, from high-end markets like Brentwood to up-and-coming areas with strong appreciation potential.

🌄 Laguna Niguel – Known for its relaxed, family-friendly vibe, close to the beach but more affordable than nearby Dana Point or Laguna Beach.

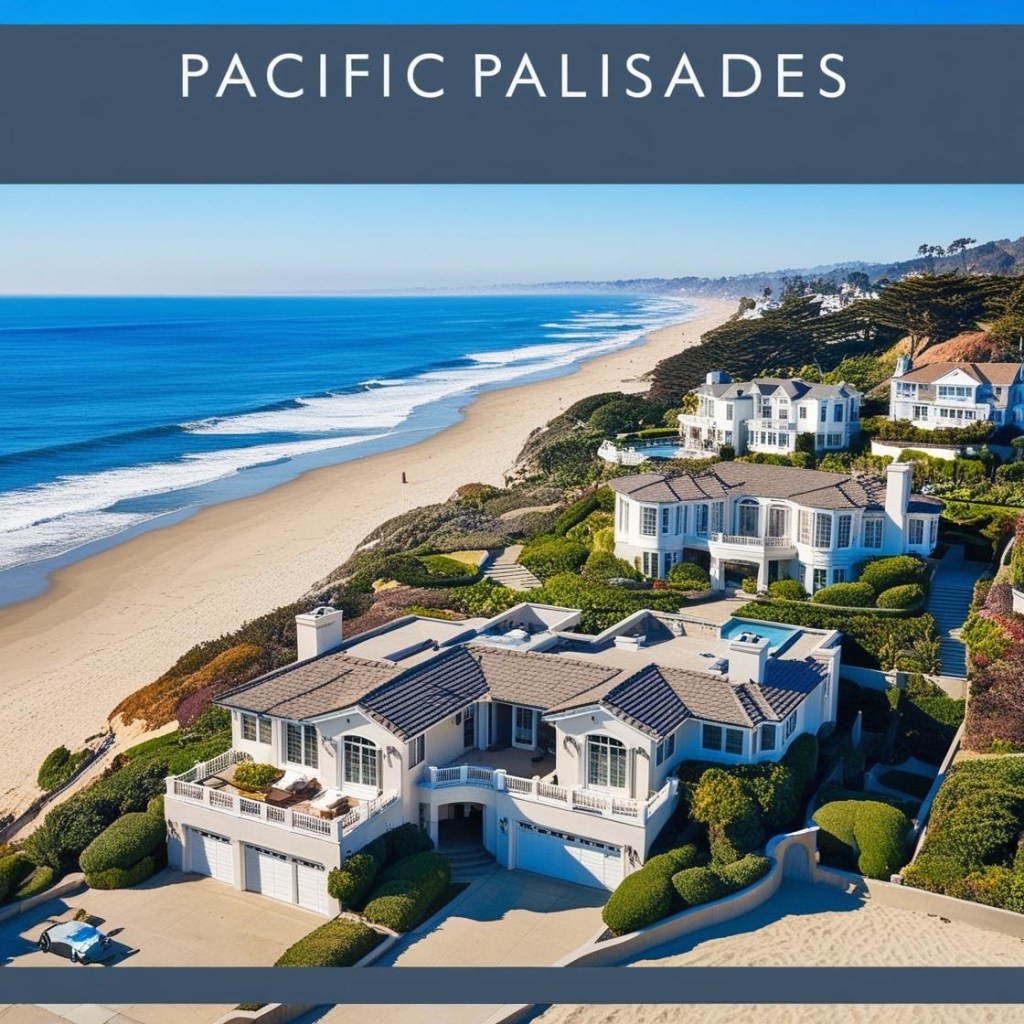

💎 Bonus Opportunity: Pacific Palisades Ocean-View Land Under $1M

If you’re looking for a prime investment opportunity, there are ocean-view lots available in Pacific Palisades for under $1 million—a rare find in one of LA’s most prestigious neighborhoods. These properties offer huge long-term value as land in high-demand coastal areas continues to appreciate.

4. Should You Wait to Buy a Home?

With high interest rates, many buyers are wondering whether to wait. Here’s why buying now might still be the best move:

- Home Prices Are Rising – Despite rate increases, demand in SoCal keeps prices high.

- Refinancing Is an Option – You can always refinance later if rates drop.

- Equity Growth – SoCal real estate appreciates over time, making early homeownership a smart investment.

If you find a home or property that fits your needs and budget, buy now and refinance later instead of waiting for a market shift that may never come.

Amin Vali Real Estate Investment Group Will Guide You Every Step of the Way

Buying a home in a high-interest rate market doesn’t have to be overwhelming—Amin Vali Real Estate Investment Group specializes in helping homebuyers and investors navigate market challenges.

✔ Find the best deals in Southern California

✔ Negotiate seller concessions to lower costs

✔ Discover off-market listings and investment opportunities

📞 Contact Amin Vali Real Estate Investment Group today! Let our experts help you make the smartest move in 2025.

Amin Vali .

B.S in Civil Engineering,MBA, Realtor

Cell phone: +1 (949)220-1000

Phone : +1(310)300-0011

Web : www.aminvali.com

E-mail : amin@aminvali.com

Instagram:aminvali

Instagram: Persianinvest.us

Facebook:amin vali

Realtor in Radius.

DRE#02104474