Buying a home in Southern California is one of the biggest financial decisions you’ll make — and understanding how much you need for a down payment is a crucial first step.

Orange County (OC) and Los Angeles (LA) remain two of the most competitive markets in the state, but their pricing and down-payment expectations can differ more than most buyers realize.

This guide breaks down current home values, minimum down-payment requirements, and realistic costs to help you confidently enter the market.

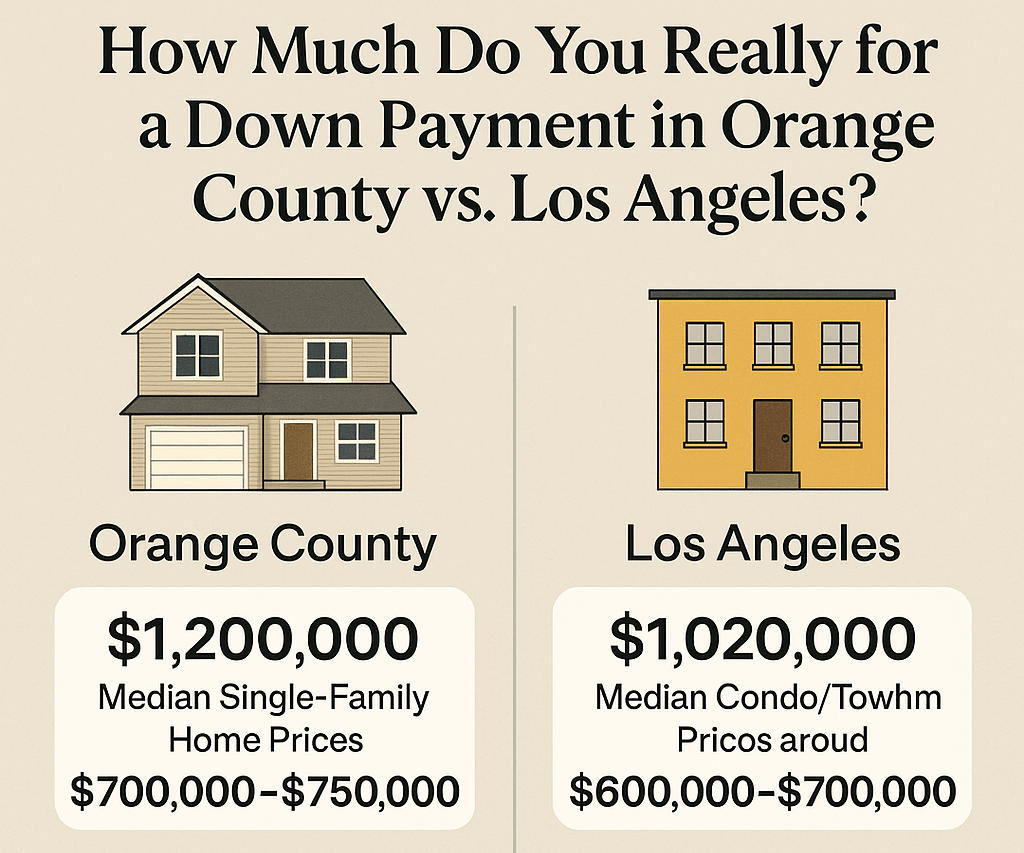

⭐ Current Home Prices in Orange County vs. Los Angeles

Orange County (OC)

- Median Single-Family Home Price: around $1,200,000

- Median Condo/Townhome Price: around $700,000–$750,000

- OC remains a high-demand region thanks to excellent schools, strong job markets, clean neighborhoods, and coastal lifestyle.

Los Angeles (LA)

- Median Single-Family Home Price: around $1,020,000

- Median Condo/Townhome Price: around $600,000–$700,000

- LA offers a wider range of prices depending on the neighborhood, from entry-level condos to ultra-luxury hillside estates.

💰 Minimum Down Payment Requirements (OC vs. LA)

Different loan programs affect how much you need upfront. Here’s a realistic breakdown based on today’s Southern California market prices:

1️⃣ Conventional Loan (Most Common Option)

- Minimum Down Payment: 3%–5%

- Standard Buyer Down Payment: 5%–10%

Example Down Payments:

- OC median home ($1.2M) → 5% down = $60,000

- LA median home ($1.02M) → 5% down = $51,000

Because home prices often exceed conventional loan limits, many buyers end up putting 10% or more, especially on single-family homes.

2️⃣ FHA Loan (Popular for First-Time Buyers)

- Minimum Down Payment: 3.5%

- FHA loans allow flexible credit requirements and lower down payments.

Example:

- Home priced at $700,000 → 3.5% down = $24,500

FHA loans are commonly used for condos, starter homes, and buyers who want a lower upfront cost.

3️⃣ Jumbo Loan (Common in OC & LA High-Cost Areas)

Many homes in both counties exceed standard lending limits, making jumbo loans necessary.

- Typical Down Payment: 10%–20%

- Some high-credit borrowers may qualify for as low as 5% down, but this is less common.

Example:

- $1.4M home → 10% down = $140,000

🔍 What Buyers Actually Put Down Today

Most Southern California buyers fall into these ranges:

| Market | Typical Down Payment |

|---|---|

| Orange County | 10%–20% (higher due to price and competition) |

| Los Angeles | 5%–15% (more variation by neighborhood) |

⚠️ Extra Costs Buyers Should Prepare For

Down payment is not the only upfront cost. Budget for:

- Closing costs (usually 2%–3% of the purchase price)

- Home inspections & appraisal fees

- HOA fees (common in condos and gated communities)

- Homeowners insurance

- Property taxes (higher in some parts of OC)

These expenses can add thousands of dollars on top of your down payment.

🎯 OC vs. LA: Which Market Is Easier for Buyers?

Orange County:

- Higher prices

- Higher down-payment expectations

- Strong demand in coastal and suburban communities

Los Angeles:

- More varied inventory

- Wider range of price points

- Easier to enter at lower down payments, depending on the neighborhood

If you want affordability and more options, LA may provide more entry-level opportunities.

If you want lifestyle, schools, and long-term value, OC continues to be a top choice.

🏡 Ready to Buy or Invest?

Work With Amin Vali Real Estate Investment Group

When it comes to buying in Southern California, having the right guidance can save you time, money, and stress.

Amin Vali Real Estate Investment Group specializes in helping buyers and investors navigate the competitive OC and LA markets with expert strategy and personalized support.

Whether you’re:

- A first-time buyer

- A move-up buyer

- A real estate investor

- Or exploring luxury homes

Amin Vali’s team will help you understand your true down-payment options, find the right neighborhood, negotiate the best price, and secure a property that fits your financial goals.

📞 Ready to start your home-buying journey?

Contact Amin Vali Real Estate Investment Group today and get expert advice tailored to your exact budget and goals.